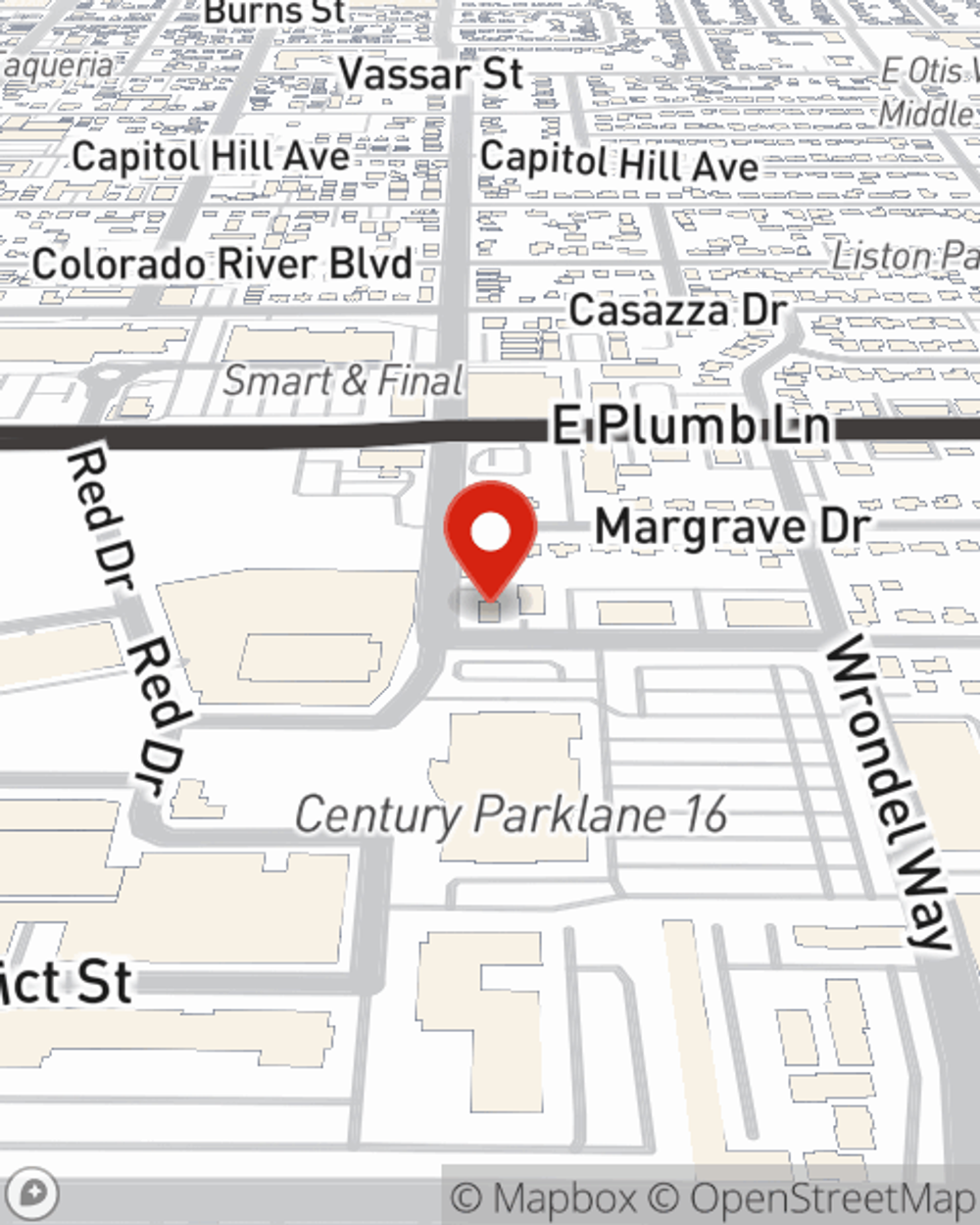

Business Insurance in and around Reno

One of the top small business insurance companies in Reno, and beyond.

No funny business here

Insure The Business You've Built.

When you're a business owner, there's so much to consider. It's understandable. State Farm agent Nelson Pinto is a business owner, too. Let Nelson Pinto help you make sure that your business is properly covered. You won't regret it!

One of the top small business insurance companies in Reno, and beyond.

No funny business here

Cover Your Business Assets

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a home cleaning service or a florist or you own a bagel shop or a dental lab. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Nelson Pinto. Nelson Pinto is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

It's time to call or email State Farm agent Nelson Pinto. You'll quickly recognize why State Farm is one of the leaders in small business insurance.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Nelson Pinto

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.